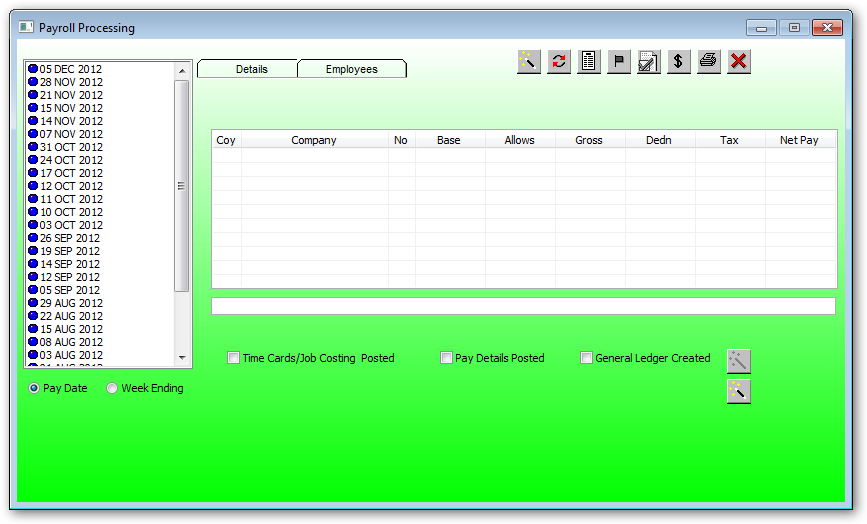

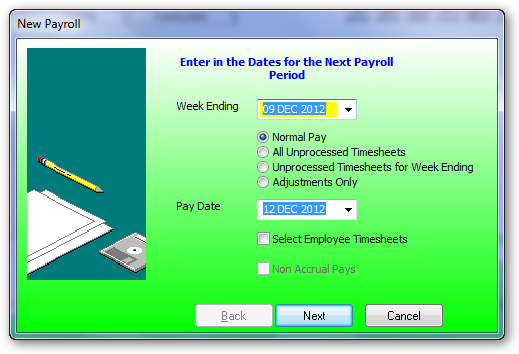

Go to PBC. Double click on payroll. Double click on payroll processing. In the top right hand corner of the page click on the wand with the stars. Enter the week ending date. This is the Sunday date. Enter the pay date. This is the date that you are processing the pays. Normal pay should be ticked. Click on next

Process the pay by pressing the buttons below from left to right.

![]()

After pressing the wand.

Select Non Accrual Pays if this pay is not to attract accruals. Non Accrual Pays are usually selected for any extra payments such as back pay if this pay is an extraordinary and the normal pay has already been processed, otherwise the extra payroll payment should be included in the normal pay.

You will now get a message to say that the following employees have no time sheets. These are the people that you left with a red dot when you processed the time sheets. They are casuals etc. They will not get paid. Click on finish. You have now converted your hours to dollars. The net pay for all employees is shown on the right side of the page.

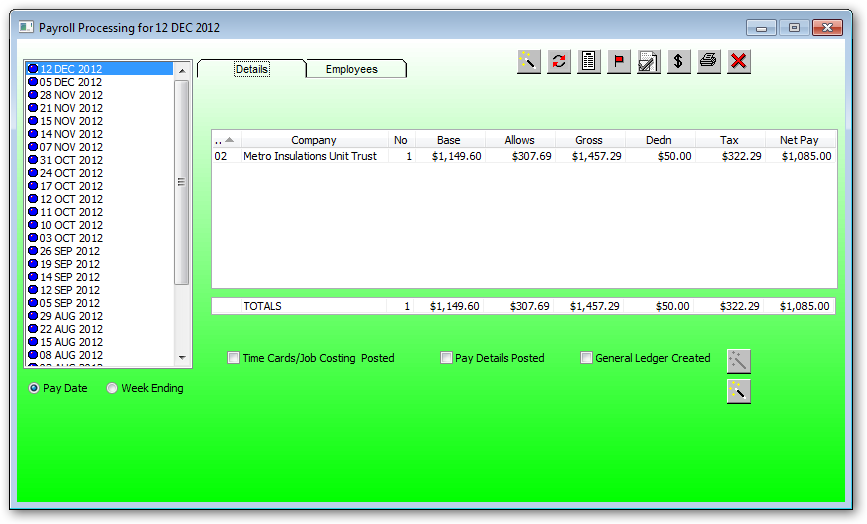

You can now click on the employees tab to make any dollar adjustments

Payroll Processing Employee List:

The employee list are all employees with a pay details record with the above pay/WE date.

The colors are as follows:

| Blue: | This pay has been posted and cannot be changed. |

| Red: | This pay has not been posted. |

| Yellow: | If his pay has not been posted then this employee has a pay-defaults reminder. |

| Green: | This pay has not been posted to general ledger and required attention. This usually occurs if there is mis balance between the time card and the pay details record. You need to fix the discrepancy and report this pay. It is advised to ring for support before proceeding with fixing this pay error. NB the GL flag in the prtrans record has not been set. |

![]()

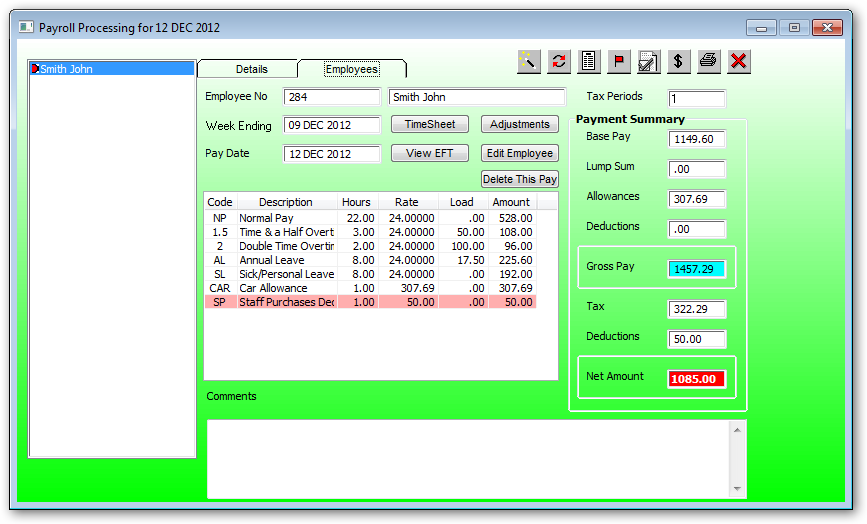

You may click on the Time Sheet button to change any hour details.

DO NOT CHANGE ANY HOUR DETAILS FROM THE DISPLAYED HOURS ABOVE.

You must do this via time card details. This is because the time card hours are also used to post pay amounts to the the job costing module at the STAFF TABLE rates.

![]()

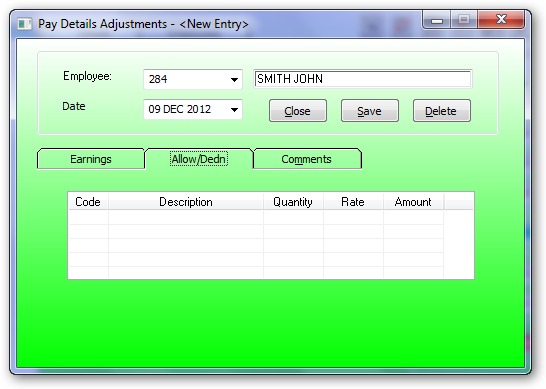

You may also add/edit an adjustment record that will adjust this pay for any allowances or deductions by pressing the Adjustments button

WARNING

If you are using time cards then do not adjust any earning hours via adjustments. Do this via time card adjustments.

Any allowances or deductions specific for this pay are entered here.

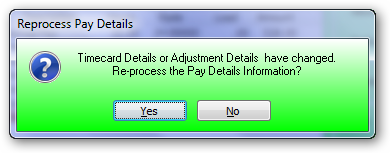

When this adjustment record is saved you will be asked to adjust this pay, answer Yes

HINT:

Also if generating a Non Accrual Pay and any allowances or deductions are not required then create a payroll adjustment with -ve qtys for each allowance/deduction to negate the entries acquired from the pay defaults data.

![]()

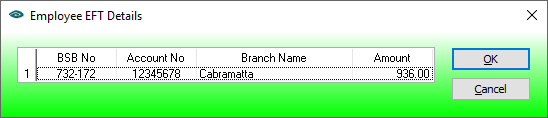

These are the EFT details for the current pay being displayed.

![]()

This is only available for unposted pay details. Go to Employee Master for details

![]()

Delete this pay if unposted. If this pay details has been deleted then you must run Process Pay Details again fo the deleted pay.