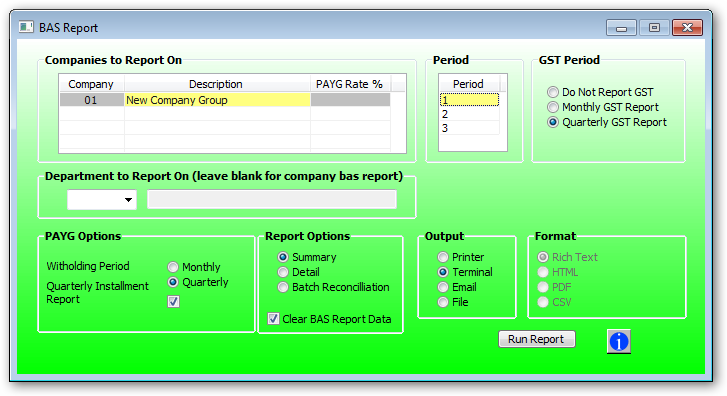

The BAS report collect details from transactions posted to the general ledger for the and payroll details. The rules for each of the BAS code are determine by the BAS code file.

PAYG Option

Withholding Period:

•Monthly

oSelect this option if you are submitting the payroll withholding tax monthly.

•Quarterly

oThis is the default option if you are submitting the payroll withholding tax 3 monthly

Quarterly Instalment Report

Select the periods you are using for your BAS report. These start with period 1 being July, 2 being August etc. Double click for list of periods.

Report Option

•Summary

oThis is the normal option to print a BAS report

•Detail

oUse this option to print all the transactions making up the BAS report.

•Batch Reconciliation

oUse this option to print a comparison report between the expected result as per rules dictated by the GL account details and the actual BAS report as per summary report.

Check the box to generate new BAS Data. Generate BAS Data may take several minutes. If a rerun of existing data is required then uncheck and the report can be rerun using data generated by the last generation.