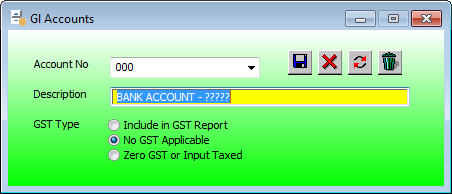

The GL Account or Master Account file stores the last digits of the General ledger chart of accounts.

This is a prerequisite to setting up a new general ledger number. Usually the description of the account master is the same across all departments such that the default description when setting up a new GL chart is from the account master. This brings consistency across departmental general ledger accounts.

GST Type:

Select the appropriate tax rules for this account master.The GST type is checked when creating a GL transaction so the user is advised if any discrepancies occur. The GST rule are usually determined by the accountant so that the user is advised as to the GST applicable for the GL transaction.

Include in GST Report:

These are accounts where the normal GST is applicable.

No GST Applicable:

These accounts are usually financial transaction accounts such a back accounts etc.

Zero GST or Input Taxed:

These accounts are usually GST exempt accounts such as food.