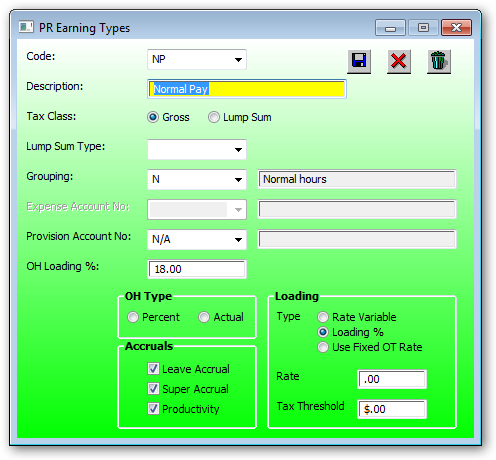

Enter the type of payroll hours used by the payroll module.

Code:

Enter the code (without spaces) or press the drop down for selection.

Description:

Enter the text for this description.

Tax Class:

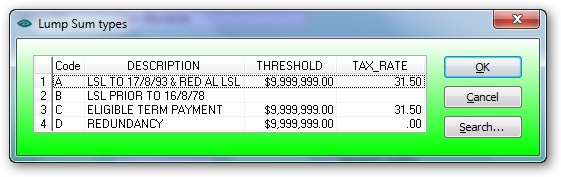

Select Gross or Lump Sum Type

If lump sum is selected the the lump sum type must be entered.

Lump Sum Type:

Enter the code or press the drop down for selection.

Enter the code or press the drop down for selection.

Expense Account No:

The expense account is enabled if the "Detailed Payroll Accruals" is checked in the group master file.

If enabled:

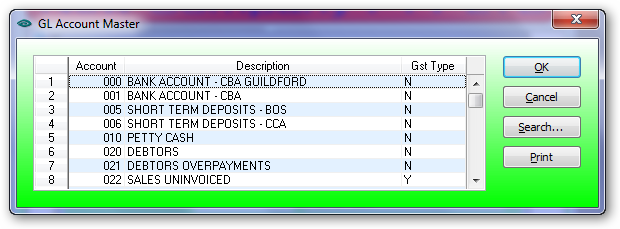

Enter the code or press the drop down for selection.

Enter "N/A" for non applicable for those hours that do not have an general ledger accrual account otherwise press the drop down to select a valid GL Account.

Overhead Loading %:

Enter the overhead loading percentage for the accrual of overhead expenses such as annual leave, sick leave etc.

NOTE: This accrual is not tax deductable and therefore needs to be taken into account at year end for tax purposes. See your accountant for details. If no overhead accrual is required then enter zero for the percent.

OH Type:

Select Percent or Actual.

For Percent the payroll system uses the above overhead loading percent.

For Actual the payroll system uses the actual amount for overhead accrual such as AL (Annual Leave).

Leave Accrual:

Tick this box if these hours are included in the leave accrual amount at a rate determined by the Staff Pay Hour Type (Hour codes table) details.

Super Accrual:

Tick this box to include these hours in the super amount at the rate determined by the super rate in the Staff Pay Hour Type

Tick this box to include these hours in the Productivity Accrual amount as determined by the productivity rate in the Staff Pay Hour Type

Loading:

Type:

•Rate Variable

o

•Loading %

oSelect Loading percent for overtime rates. Must enter a rate in the rate box if Loading % is selected.

•Use fixed OT rate

oFixed OT rate is used to override the normal overtime rate by a fixed overtime amount independent of the number of hours worked. eg. Saturday work at $200.00 fixed

Rate:

Enter the rate in percent. E.g. 50 for time and Half overtime, 100 for double time etc.

Enter the tax threshold amount if applicable. E.g AL (Annual Leave) has a tax threshold of $320.00 at which point no tax exemption is calculated to annual leave at annual leave loading (17.5 %) amount. The year to date (YTD) annual leave loading amount is location in the employee details (group certificate details).