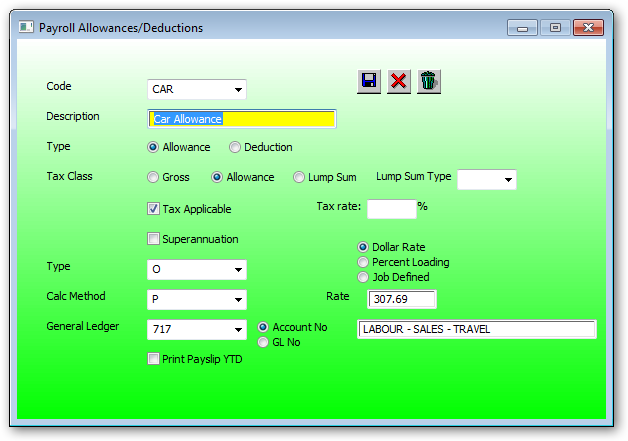

Overview:

Payroll allowances/deductions are used to add/subtract amounts to the gross pay complying with predetermined rules defined by the parameters associated with the allowance.

Code:

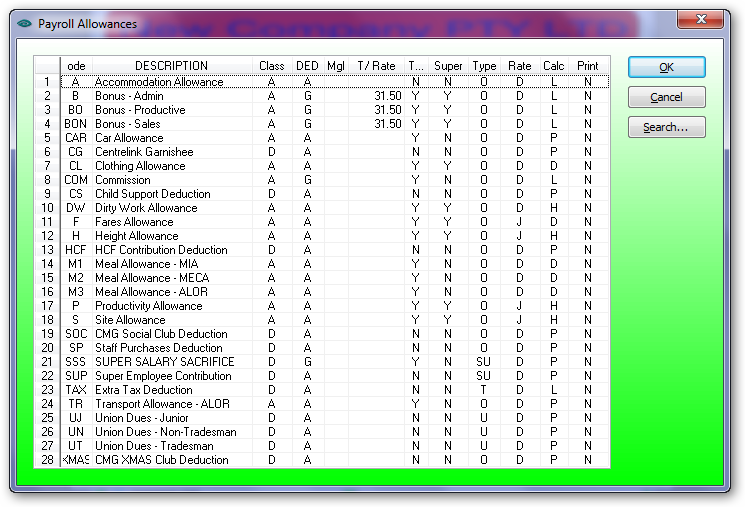

Enter a new code (without spaces) or press down arrow for existing list for selection

Type:

Select allowance to add to the payroll amount OR Deduction to reduce the payroll amount.

If the tax class is GROSS then this allowance/deduction will not be reported on the group certificate but is included in the gross amount reported on the group certificate.

If the tax class is ALLOWANCE then this allowance/deduction will be reported on the group certificate and is included in the gross amount reported on the group certificate.

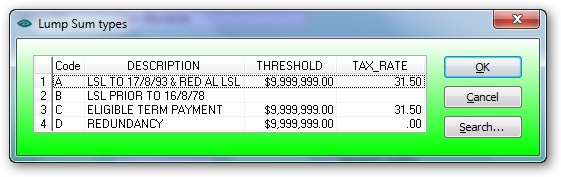

If the tax class is LUPSUM then this allowance/deduction will be reported on the group certificate in the lump sum column. If selecting lump sum then the lump sum type must also be selected.

Tick this check box if this allowance is to be taxed.

Allowance tax rate:

A non blank precentage will replace the normal tax rate for this allowance.

Warning messages will appear to ensure the correct option is selected.

For an ALLOWANCE type and tax applicable is checked then the allowance amount will increase the taxable gross amount otherwise the taxable gross amount will not include the allowance amount.

For a DEDUCTION type and tax applicable is checked then the deduction amount will be reduce the taxable gross amount otherwise the taxable gross amount will include this deduction amount.

If Superannuation is checked then the allowance amount is included in the calculation of superannuation.

Superannuation should not be checked for deductions but for allowances only.

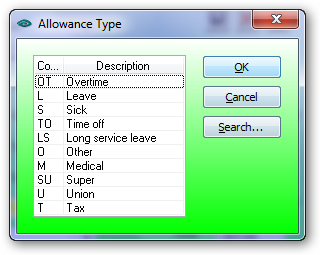

Enter the code or press the drop down for selection.

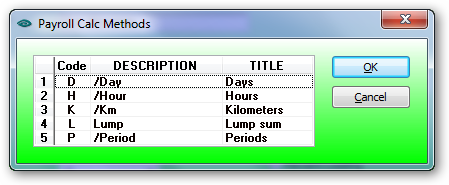

Enter the code or press the drop down for selection.

Enter the code or press the drop down for selection.

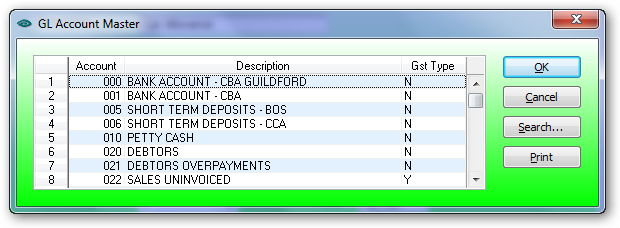

If the Account radio button is selected then the GL Account Master popup will be displayed:

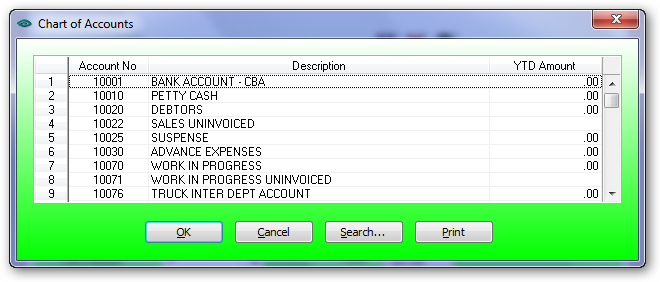

If the GL No radio button is selected then the Chart of Accounts popup will be displayed:

Tick this check box if this allowance is to print the Year To Date amount on the payslip. The YTD amount will include the current pay after posting.

Select (D)ollar rate,(P)ercentage loading or (J)ob file defined

Enter the rate depending on the rate type selected.

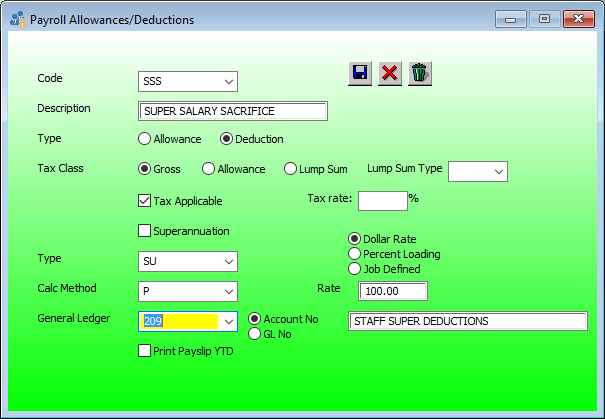

The following is an example of a typical setup for deducting extra super as a salary sacrifice.

This will accumulate extra super amounts in the general ledger account for payment clearing.

Any extra super will be reported in the super report and included in the super upload file to the appropriate super fund.