PBC payroll is an approved provider to process single touch payroll. Each payroll is required to be submitted to the ATO via STP.

The STP processing screen has been designed with simplicity of use in mind however there are minimum functionality requirements set down by the ATO. The various functions have all been made available to users of PBC STP and for the most part the way that you use them is much the same across all functions.

STANDARD REGULAR PROCESSING

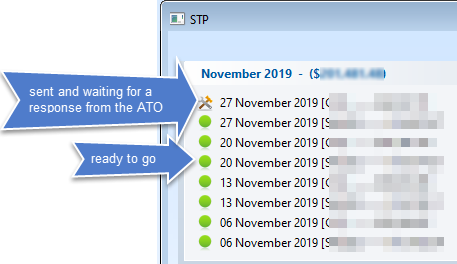

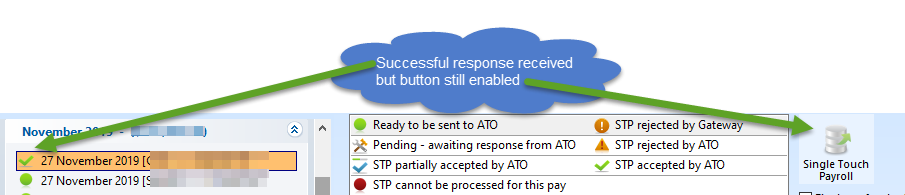

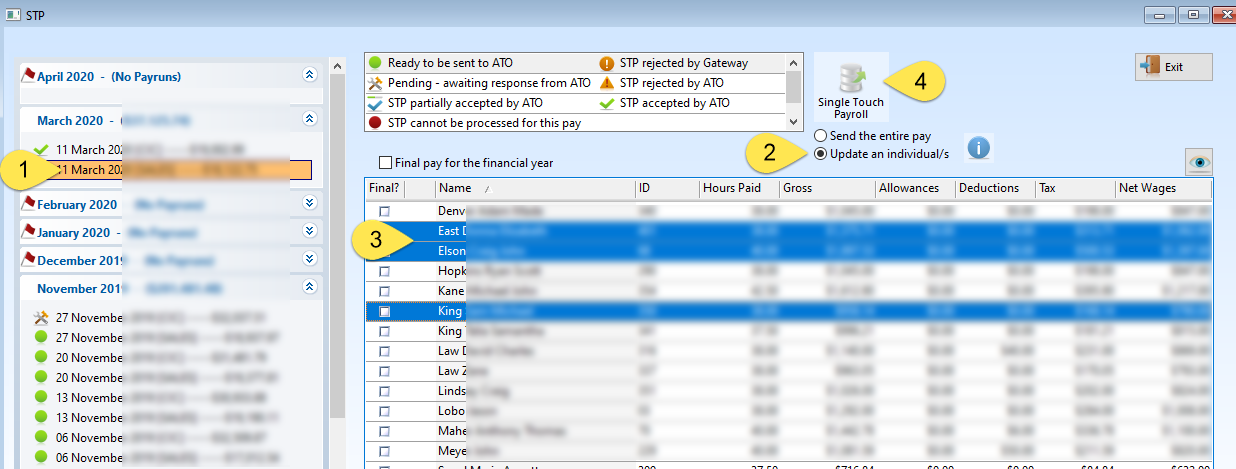

The icons next to each pay are used to indicate the status of the pay. A green circle is your “good to go” indicator that indicates the pay is ready to be processed and sent to the ATO.

1.Select a “go” pay on the left and the details will be displayed in the table on the right hand side

2.Click the big “Single Touch Payroll” button.

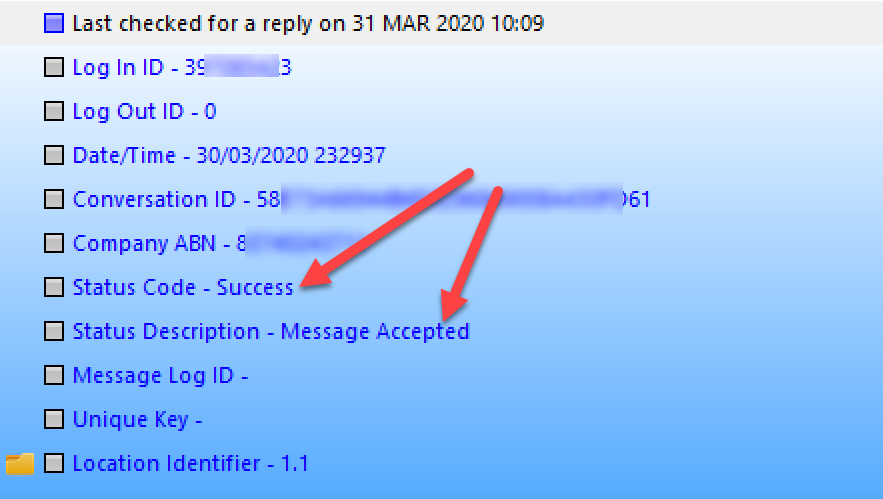

PBC will then validate each individual in the pay to ensure they meet the data validation requirements set by the ATO and then if all is ok, will send it through to the ATO. The green go icon will then change to the construction icon indicating that it has been sent and the ATO is working on it. This icon will remain until such time as you receive a reply from the ATO stating whether or not they have accepted the submission. Any response from regarding the STP process can be displayed by pressing the "EYE".

![]() .

.

CHECKING FOR A RESPONSE FROM THE ATO

It may take the ATO anything from five minutes to three days to process your submission so it is the responsibility of the user to periodically check whether or not a response has been sent. Fortunately it is easy to do this. The steps are the same as for the original submission. Select a pay with a construction icon and then click the “Single Touch Payroll” button. Usually you will receive a response within approximately 15 minutes. A successful submission will update the construction icon to a green tick to indicate all is good. In normal circumstances this would be the end of the STP processing for most pays however there may be occasions where you identify an issue with the submitted pay and need to provide the ATO with a correction. There are two ways to correct anomalies with a previously submitted pay. They are

1.Full File Replacement or

2.Update an individual or individuals pay only.

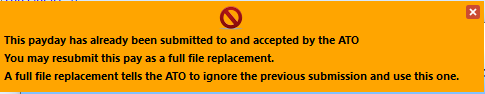

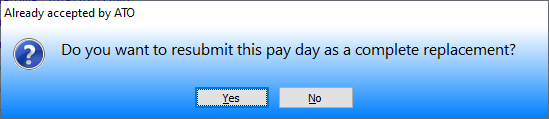

FULL FILE REPLACEMENT

It is now possible to resubmit an already successfully submitted payroll via a full file replacement. This process tells the ATO to completely ignore what you sent for this pay last time and replace it completely with what you are sending this time. Generally speaking there should be no need to do this and as such if you do click the button on a pay that has already been successful, you will see a large message explaining what you have done and then a second message giving you the chance to change your mind. If you click “Yes”, then this submission will completely replace the previous one.

Note, you should only do this when there is a genuine need to replace the previous submission. This would only be in cases where you are making a correction to the pay. In most cases, corrections can simply be made as part of the submission of the following pay period.

UPDATING INDIVIDUALS

On the occasion where you have successfully submitted a pay and then you subsequently identify an error with just one person or a handful of people in the pay, you can resubmit using the “Update an individual/s” option instead of resubmitting the entire pay. An example of where you may require this is if you notice that an employee’s tax file number is incorrect. You correct the TFN within PBC and then you may update the individual’s last pay using this option. The update event tells the ATO that everything about the pay is correct other than this person or persons I’m sending right now.

1.Select the pay you need to modify.

2.Select the “Update an individual/s” option underneath the “Single Touch Payroll” button.

3.Select which employees you want to update by highlighting the row they are in. You can select multiple people by holding the Ctrl or Shift keys on your keyboard whilst you click the rows.

4.Click the “Single Touch Payroll” button.

5.From here on in, the process works the same as for a standard submission but is limited to the selected individual/s only.

END OF FINANCIAL YEAR

The introduction of STP means that the end of financial year processes have changed. If you are STP compliant there is no longer a requirement to send Payment Summaries to your employees nor is there a need to report to the ATO via the sending of an end of year file commonly known as the empdupe.

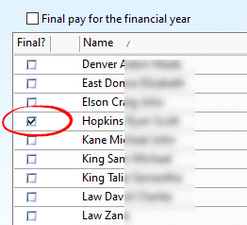

You are however required to inform the ATO when you have completed the pays for all employees so that the ATO knows that what they have on record is complete and each individual can have their tax obligations processed. This notification is sent on an employee by employee basis. It is not a company indicator. You must flag each individual employee’s final pay as the final pay for them. This caters for the occasions where an employee is terminated part way through the year. When you send the pay that includes that employee’s final pay, you must inform the ATO that it is indeed the final pay for them.

To indicate the final pay for an employee, check the box in the first column (the one labelled “Final?”) next to the relevant individual’s name. In this example, this is a regular weekly pay for everyone except Mr Hopkins. He has worked his final days for this company and checking this box is the equivalent of providing him with his Payment Summary.

At the end of year, you will need to check the box for all employees when sending the last pay for the financial year. If you have numerous employees this could be tedious. For that reason, the “Final pay for the financial year” checkbox has been provided. Checking this box will automatically check all the boxes in the table. Similarly, unchecking the box will immediately uncheck all the boxes in the table.

This overriding checkbox is for your convenience only. It does not directly affect the output that is sent to the ATO. The checkboxes next to each individuals names are the important ones.