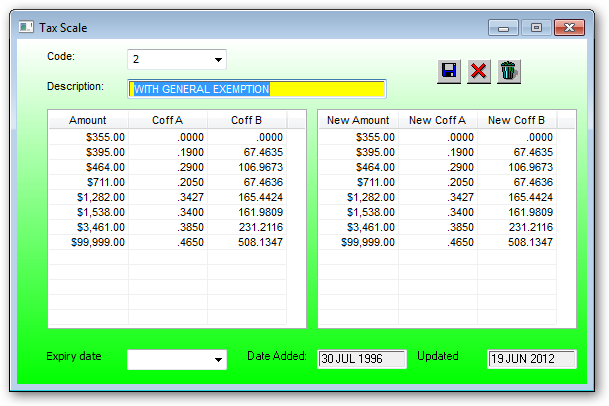

The tax scales are those supplied by the ATO. Normally each financial year new tax scales are supplier by the ATO. You may enter the new tax scales in the New Amount table then enter the activation date at which date the new tax scales will automatically update the current tax scale. The user will be prompted to update the tax scale during the "Payroll Processing" function.

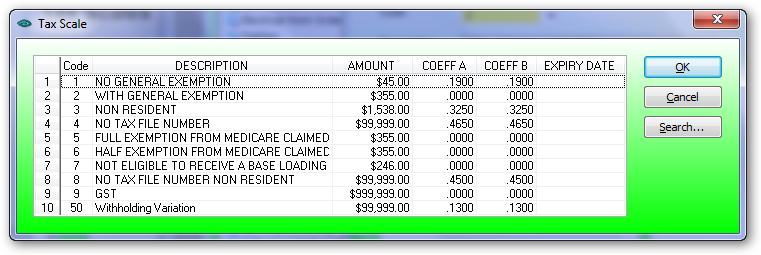

Code:

Enter an existing code or use the drop down to select an existing tax scale.

Tax Tables:

Enter the complete tax table data as supplied by the ATO. Must enter a large amount in the last Amount and New Amount. E.g $99,999.00

Expiry Date:

Enter the date at which the new tax scale is to be transferred to the current tax scale. After the transfer this date will be blank ready for the next expiry/update date.

Must enter the new tax scales before entering a new expiry date.