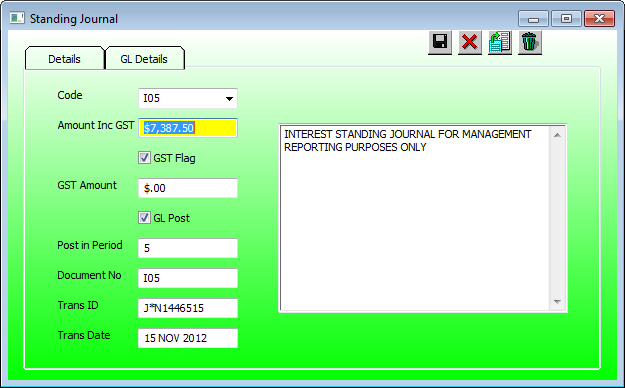

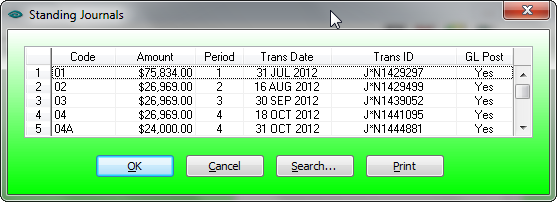

Enter the standing journal details prior to posting the standing journal. The normal process is to display an existing standing journal (use code dropdown) and copy (press copy button![]() )the details to an new standing journal

)the details to an new standing journal

Details

Code:

Enter an new standing journal code or press the dropdown to display existing standing journals.

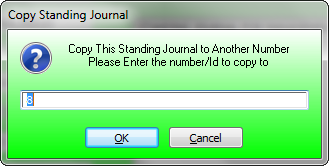

![]() Copy Journal

Copy Journal

Display an existing journal and press the copy button:

Enter the code of the standing journal to be saved. The default is the next available numeric number but it is normal to enter the next code number belonging to the group of journals from which the journal was copied. After the copy don't forget to enter the posting period for the journal to be posted.

The code entered must NOT already exist as a journal code.

Amount Inc GST:

Enter the journal amount including GST.

GST Flag:

Check the GST flag if the journal includes GST.

GST Amount:

The GST amount is zero if the GST flag is not set otherwise the GST amount default is displayed.

Post Period:

Enter period for which this journal is to be posted. You may enter a future period to record a journal to be posted at a later date.

Leave the post period blank if this journal is used as a reference journal used to be copied only.

Document No:

The default Document is the copied from journal code if this journal was created using the copy function.

Trans ID:

This contains the transaction id after the journal has been posted.

Trans Date:

This contains the transaction date after the journal has been posted.

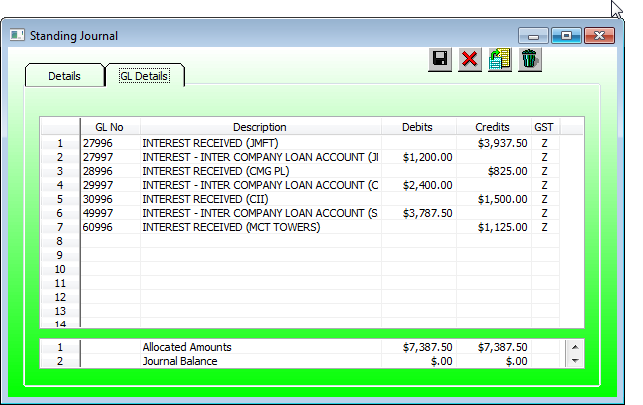

GL Details

Enter the general ledger codes, debit and credit amounts similar the way a normal GL journal is created.

The total debits must equal the total credit amount and must equal the Amount Inc GST.