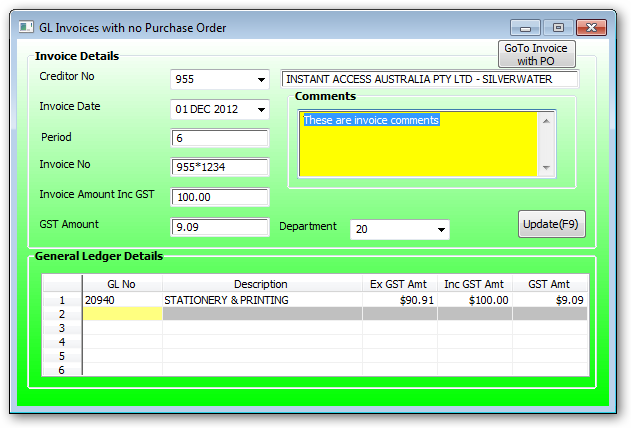

AP General Ledger Invoice:

Enter creditors GL invoices that do not have a purchase order. For example if you have an invoice from Telstra and it has been set up as a credit to control costs then use this window to process creditor invoice.

Invoice Date:

Enter the invoice date on the creditor invoice, You will not be allowed to enter a date after today.

Period:

Automatically entered depending on the invoice date.

When entering an Invoice the number that you enter here must not already exist in the Creditors Transaction file if it does the program will respond with the message "Invoice already exists press any key to continue". The pressing of any key at this stage will return you to the invoice prompt. The reason for this is you cannot have two invoices in the file with the same number. This gives you a fast method for finding the invoices that are being paid when the creditors account is operation in the open item method.

The invoice number is automatically preceded with the creditors number so that this invoice number is unique to this creditor.

Invoice Amount Inc GST:

Enter the total invoice amount including GST.

Use the default GST amount.

If the GST amount is not the default value then override this default with the correct value. If the difference is more than 5 cents then use the procedure as indicated in the table below.

The default department uses the first 2 charaters of the first entry in the General Ledger Details table. If this is not the correct department then override the department.

This is a 40 character alpha/numeric field and you can enter here any data that you feel significant to the entry.

Payment Procedure with GST greater than 10%:

1.Multiply the GST amount by 10 and enter this amount into amount ex GST and use the default GST amount.

2.Enter the same amount but -ve value into the next line and ZERO the GST amount.

3.Enter the invoice amount ex GST (Usually the default) and ZERO the GST amount.

The above procedure will let you enter the GST amount separately from the invoice amount.

Note:

The original invoice where you paid no GST (Eg overseas invoice) should be in the same period as the above transaction. If this is not the case you may get a -ve value in the BAS report. The TAX department does not accept -ve values on the BAS report so you may need to adjust the BAS report manually.

The general Ledger number is verified to ensure there is no posting to a control account.

Control accounts include:

Bank

Debtors

Creditors

Inventory

WIP (Work in Progress)