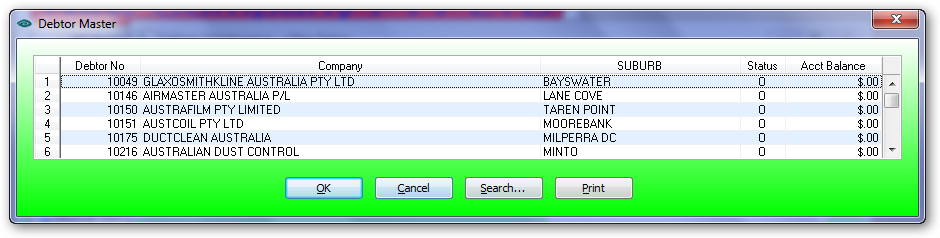

Debtors Masterfile

The debtor record must be created using the Client Customer/New Customer function before being edited.

Debtor No:

Type in the company name for the system to display entries in the database and select from the list.

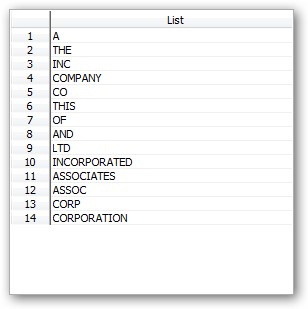

Type in say "AUST" and all the companies with any word starting starting with 'AUST'. If a bracket "]" is used after the search word the all debtors containing the work 'AUST' will be displayed for selection. Some search words are excluded from the search including:

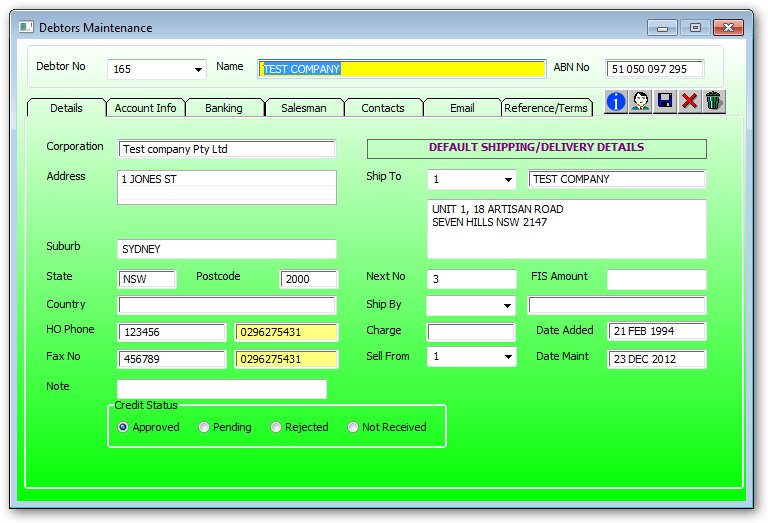

Name:

Enter the company name. Usually the same as the customer name.

ABN:

Enter ABN number for Australian companies

Most of the data field will be populated from data entered under Client Customer\New Customer

Details Tab:

Corporation:

Enter the legal entity name if the trading name is used

Country:

Enter the country of the customer

Multiple delivery addresses can be created for a customer. Additional delivery address for the customer is created under Sales Order Entry\Delivery Addresses.

Enter the freight company that usually delivers.

Enter the free into store $ value. Above this order value freight will be charged.

Enter the default delivery charge used in the order entry module.

Warehouse from which goods are usually sold from.

FIS Amount Amount before any freight is charged. Leave blank

Ship By Select from the drop down list the mode of transport. Use 1 for default transport

Charge Standard freight charge per invoice if applicable. This amount will be added to every invoice created

Sell From Select from the drop down list the warehouse for the customer.

The warehouse selected will determine the sale currency

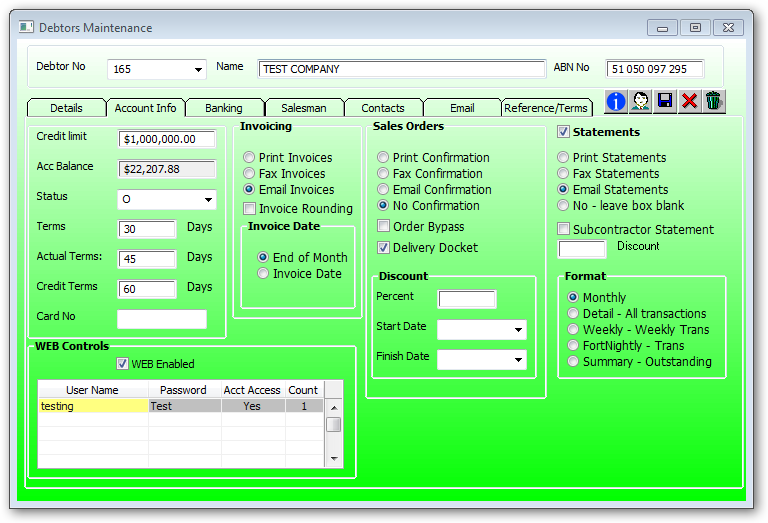

Account Information Tab:

Credit Limit:

Enter the credit limit amount for the customer. The user authority to change this field is in System Functions\User Access in Modules\Allowed to Change Credit Limit.

Acc Balance:

Displays the current account balance for all departments.

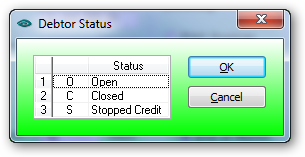

Select 'O' for open for an active account

A debtor on stop credit will prevent any financial transaction such as confirming sales order or invoicing a job.

Enter the number of days for the trading term. Zero terms indicate a cash sale debtor. This will print cash sale on picking slips.

Add further 30 days to the term days. Used for cash flow.

Add further 60 days to the term days.

The number of days before a debtor is put on stop supply after the stop credit routine is run.

Card No:

Used to record the MYOB card number

Invoicing:

•Print Invoices

•Fax Invoices

•Email Invoices

Tick this box for cash sale customers. The rounding amount is printed on the invoice. The rounding value is stored in the group master record.

Invoice Date:

•End of Month

•Invoice date

Sales Orders:

•Print Confirmation

•Fax Confirmation

•Email Conformation

•NO Confirmation

Order Bypass:

Tick this box to print a delivery docket when confirming a picking slip.

Reprints "File Copy" and/or "Customer Copy"

Discount:

Enter the discount percent. This discount will apply to all all stock sales and will be included in the overall discount percent. This include Sell code Discounts, Item Discounts and Qty discounts as defined in the discounts as per sales order module.

Start Date:

Finish Date:

If a discount has expired then the user will be advised via a message on the screen.

NOTE:

Make sure the the finish date is blank after discount expiry date otherwise the WEB sales will stop as it cannot display a message on the web page.

Statements:

•Print Statement

•Fax Statement

•Email Statement

•NO Leave box blank

Note: If emailing statements then the email address must be setup in the email section.

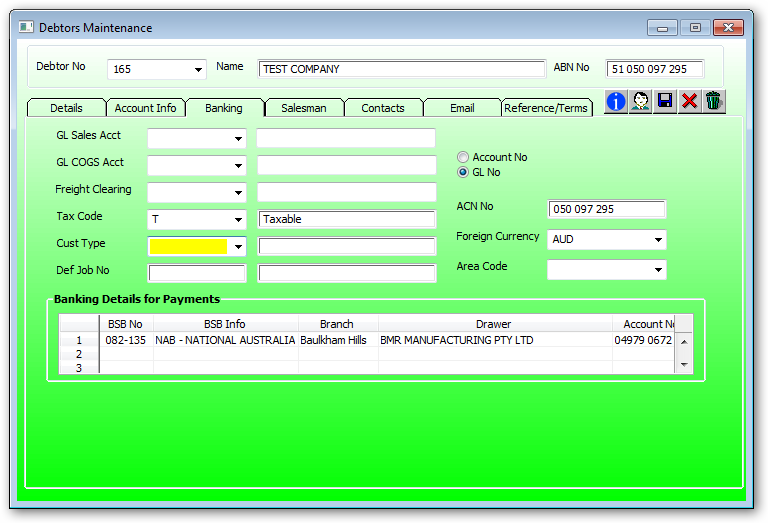

Banking Tab:

GL Sales Account:

Enter the general ledger sales account for the customer.

GL COGS Account:

Enter the general ledger COGS account for the customer

Freight Clearing:

Freight Clearing Enter the general ledger freight recovery account if there is freight outwards applicable for the shipment. The calculated freight amount is added to the invoice journal as a debit to cost of goods sold and credit to the freight recovery account.

Tax Code:

This code is used to calculate GST. Select E for export customer or T for taxable on local customer.

Select the debtor customer type from the drop down.

Customer type is used for report with the following exceptions.

If a customer type is "E" then this is an export customer and no GST will be charged on invoicing.

If a customer type is "C" then the debtor receipt process will not request banking details when for cheque payments.

If a customer type is "B" then these debtors will be included on the rebate report (electrical only).

If a customer type is "H" for customer where a work order is required to be created electronically without having to create the sale order. Stocking for Helen kaminski Pty Ltd and Statesman Hats for Sri Lanka stocking are two examples. If customer type is Stocking, electronic processing of sale order will allow creation of the sale order and not the work order. Sales for customers with the stocking code will not appear on the "Bag Report".

Def Job No:

This is the same number as the customer and is created when the customer record is created. Existing customer requiring a job number will need to be created manually. For electrical customers the def job no is used as the job no for a debtor when creating the electrical work order

ACN Number:

Enter the ACN number for Australian companies.

Foreign Currency:

Select the customer sale currency from the drop down list

Area Code:

Usually left blank. If bulk mailing then mail may be pre sorted by this area code or mailing centers.

Banking Details for Payments:

BSB Enter BSB from customer cheque received

BSB Info Enter BSB info from customer cheque received

Branch Enter Branch from customer cheque received

Drawer Enter Drawer from customer cheque received

Account No Enter Account No from customer cheque received

Salesman Tab

Dept Double click and select 10 for Balance Sheet

Description Department description from the code selected

Salesman There must be a salesman for every customer. Double click and amend the salesman code if not correct

Name Salesman description is displayed from the code selected

RCTI Leave blank (Recipient Created Tax Invoice)

Price Code Double click and select a price code such as L for List, W for Wholesale

Description Price code description is displayed from the code selected

Contacts Tab

Contact codes in the contacts table are references to the contacts in the contacts file also accessible via the Telephone Icon ![]() on the main form.

on the main form.

Right click on a row to:

Edit Contact if selecting an existing contact

Add Contact for a new contact

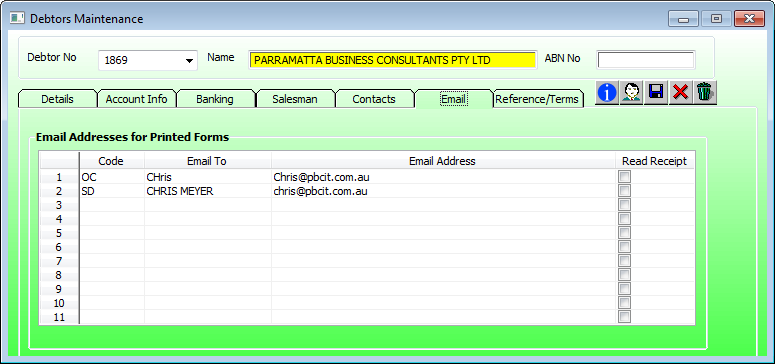

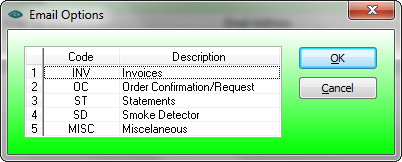

Code Right mouse click to display email code. Select INV for invoice, OC for order confirmation, or ST for statement

Email to Enter name of the contact

Email address Enter email address of the contact. The email comes up automatically if set up correctly in Contacts

Terms Tab

Invoice Terms

Enter the selling terms details for printing on the sale confirmation and invoice